Opaque, unaccountable, and disengaged: What the CEO’s secretive visit says about platform power in Korea

The Travelnews ㅣ Jungchan Lee

When Airbnb CEO Brian Chesky visited Seoul, it wasn’t reported. Not in advance, not during, and hardly even after. No press conferences, no public schedule, no industry roundtable. A CEO of the world’s largest accommodation platform entered a major market and left — without meeting the market.

This wasn’t a logistical oversight. It was a deliberate act of exclusion.

The event was tightly embargoed. Details such as the date of arrival, attendees, or even the content of announcements were either controlled by Airbnb’s PR machine or omitted entirely. Major Korean travel media were not invited. Journalists didn’t ask questions — because they weren’t in the room.

What was the agenda so sensitive that it required near-total media blackout? A product update. A K-pop tie-in. Nothing that justified the secrecy — unless the secrecy itself was the point.

Airbnb calls Korea a “strategically vital market.” But its actions reflect something else: a market to be harvested, not engaged. Korea is where Airbnb sells experiences, but not where it listens. Not where it explains. Not where it shares control.

The “SEVENTEEN x Airbnb” collaboration is a perfect case study. On the surface, it celebrates Korean culture. In reality, it repackages K-pop as a global commodity, bypassing local stakeholders. The question is not who benefits — but who’s even involved. No mention of local hosts, small travel creators, or community partners. Korean culture is used, not partnered with.

This pattern mirrors Airbnb’s broader regulatory posture in Korea. In 2023, the company announced “voluntary compliance” with local accommodation laws. It framed this as leadership. But it was strategic preemption: comply before regulation arrives, shape the narrative before the law can.

That same strategy is visible here. Control the information. Manage the media. Avoid critical scrutiny. The fewer questions, the fewer answers required.

Meanwhile, Korea’s institutions remain unprepared. Tourism officials celebrate foreign investment, but overlook platform accountability. The media repeats press releases without investigation. Local travel industries — from guesthouses to content makers — are systematically excluded.

Airbnb didn’t just visit Korea. It bypassed it.

The platform that claims to connect the world has connected nothing here — not the press, not the local travel ecosystem, not even the public it claims to serve.

So the question stands:

Is Korea truly a strategic market for Airbnb — or merely a strategic consumer base?

A partner, or a passive backdrop?

Without transparency, inclusion, or dialogue, Airbnb risks being remembered not as a bridge between cultures — but as a gatekeeper of access, profit, and control.

에어서울은 단순한 항공권 할인에서 한 발 더 나아갔다.

에어서울은 단순한 항공권 할인에서 한 발 더 나아갔다.

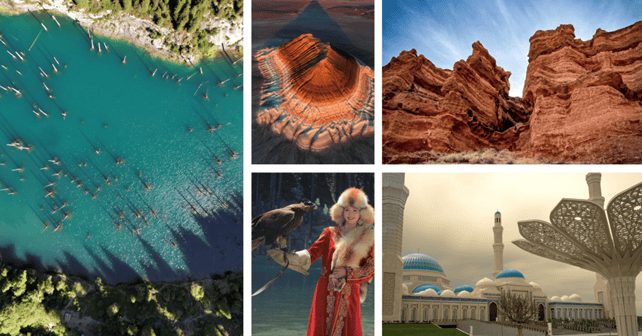

이날 설명회의 중심은 누르갈리 아르스타노프(Nurgali A. Arystanov) 주한 카자흐스탄 대사.

이날 설명회의 중심은 누르갈리 아르스타노프(Nurgali A. Arystanov) 주한 카자흐스탄 대사.

![A[이미지6] 시크릿 도어스 오브 마카오 컬러풀 빌리지 존](https://thetravelnews.co.kr/wp-content/uploads/2025/06/A이미지6-시크릿-도어스-오브-마카오-컬러풀-빌리지-존-696x463.jpg)

행사 첫날, 더현대 서울 5층 사운즈 포레스트에서는 오프닝 세리머니가 개최됐다. 방송인 안현모의 사회와 가수 폴킴의 감성 공연이 어우러진 이 자리는, 관광청 본청 및 국내 여행업계 관계자들이 대거 참석한 가운데 마카오의 새로운 면모를 알리는 공식 출발점이 되었다.

행사 첫날, 더현대 서울 5층 사운즈 포레스트에서는 오프닝 세리머니가 개최됐다. 방송인 안현모의 사회와 가수 폴킴의 감성 공연이 어우러진 이 자리는, 관광청 본청 및 국내 여행업계 관계자들이 대거 참석한 가운데 마카오의 새로운 면모를 알리는 공식 출발점이 되었다. 특히 눈길을 끈 하이라이트는 ‘마카오로 순간이동’이라는 이벤트였다. 여행 커뮤니티 ‘여행에미치다’와 협업해 진행된 이 프로그램은, 사전 응모자 중 현장에서 추첨을 통해 선정된 네 명에게 항공·숙박·식비가 전액 지원되는 2박 3일 마카오 여행 기회를 제공하며 현장의 열기를 더했다.

특히 눈길을 끈 하이라이트는 ‘마카오로 순간이동’이라는 이벤트였다. 여행 커뮤니티 ‘여행에미치다’와 협업해 진행된 이 프로그램은, 사전 응모자 중 현장에서 추첨을 통해 선정된 네 명에게 항공·숙박·식비가 전액 지원되는 2박 3일 마카오 여행 기회를 제공하며 현장의 열기를 더했다.

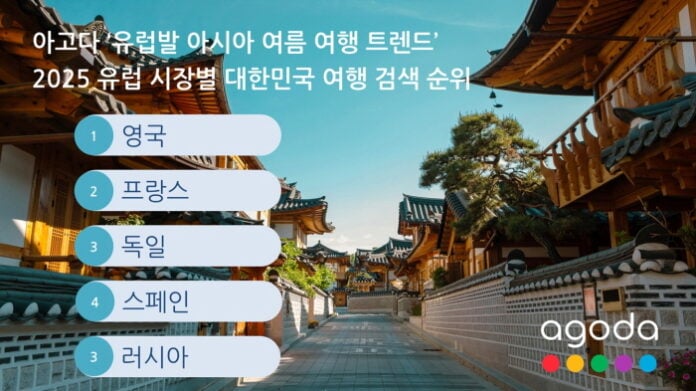

특히 제주도는 올해 처음으로 톱3에 진입했다. 이는 넷플릭스 시리즈 ‘폭싹 속았수다’를 통해 제주가 해외 시청자에게 노출되면서 이미지 각인 효과를 거둔 것으로 풀이된다. 지난해까지 제주를 앞섰던 경주는 올해 4위권으로 밀려났다.

특히 제주도는 올해 처음으로 톱3에 진입했다. 이는 넷플릭스 시리즈 ‘폭싹 속았수다’를 통해 제주가 해외 시청자에게 노출되면서 이미지 각인 효과를 거둔 것으로 풀이된다. 지난해까지 제주를 앞섰던 경주는 올해 4위권으로 밀려났다.

![[사진 5] 식사 코스 사이사이 눈과 귀를 사로잡는 퍼포먼스가 이어졌다](https://thetravelnews.co.kr/wp-content/uploads/2025/06/사진-5-식사-코스-사이사이-눈과-귀를-사로잡는-퍼포먼스가-이어졌다-696x464.jpeg)

![[사진 4] 갈라 디너에서 가수 비(Rain)가 화려한 퍼포먼스를 선보이고 있다](https://thetravelnews.co.kr/wp-content/uploads/2025/06/사진-4-갈라-디너에서-가수-비Rain가-화려한-퍼포먼스를-선보이고-있다-696x464.jpg)

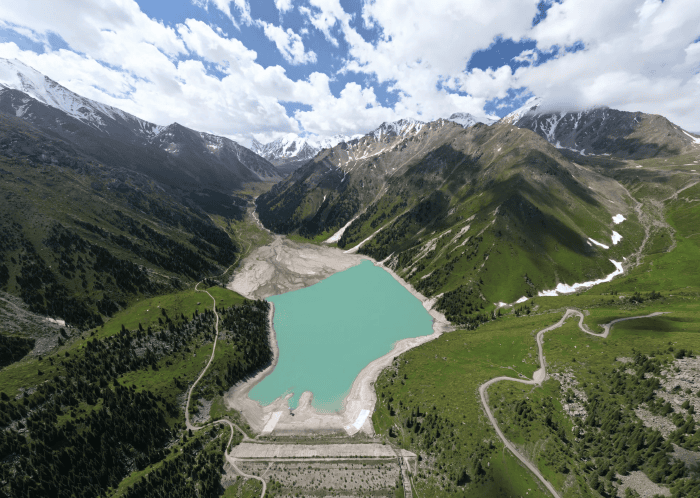

정상에 오르자 세상이 넓어졌다. 저 멀리 일렁이는 지평선과 띠처럼 이어진 황금빛 사막. 그리고 언덕 반대편으로 펼쳐진 이리강 계곡이 언뜻 보였다. 모래 위에 나는 발자국이 쓸려가며 사라졌고, 그 순간 정말로 바람이 불었다. 처음엔 바람 소리 같았지만, 이내 땅속에서 울리는 듯한 묘한 진동이 느껴졌다. 어렴풋하게, 낮고 길게 이어지는 소리가 들렸다. 귀로 들린다기보다, 몸으로 스며드는 느낌이었다. 그것은 확실히 ‘노래’였다. 누가 부르는 건지, 어디서 나는 건지 알 수 없지만, 그 소리는 지금 이 순간 내가 여기에 있다는 사실만큼은 분명히 했다.

정상에 오르자 세상이 넓어졌다. 저 멀리 일렁이는 지평선과 띠처럼 이어진 황금빛 사막. 그리고 언덕 반대편으로 펼쳐진 이리강 계곡이 언뜻 보였다. 모래 위에 나는 발자국이 쓸려가며 사라졌고, 그 순간 정말로 바람이 불었다. 처음엔 바람 소리 같았지만, 이내 땅속에서 울리는 듯한 묘한 진동이 느껴졌다. 어렴풋하게, 낮고 길게 이어지는 소리가 들렸다. 귀로 들린다기보다, 몸으로 스며드는 느낌이었다. 그것은 확실히 ‘노래’였다. 누가 부르는 건지, 어디서 나는 건지 알 수 없지만, 그 소리는 지금 이 순간 내가 여기에 있다는 사실만큼은 분명히 했다.

마카오정부관광청은 이날 ‘Macao Tourism + MICE Product Updates Seminar & Travel Mart’라는 이름으로 2025 마카오 위크의 포문을 열었다. 한국 여행업계 200여 명이 참석했으며, 해를 거듭할수록 더 깊어진 네트워크가 체감되는 자리였다.

마카오정부관광청은 이날 ‘Macao Tourism + MICE Product Updates Seminar & Travel Mart’라는 이름으로 2025 마카오 위크의 포문을 열었다. 한국 여행업계 200여 명이 참석했으며, 해를 거듭할수록 더 깊어진 네트워크가 체감되는 자리였다.

![[Travel Korea] Jongmyo: Walking into the Soul of Joseon](https://thetravelnews.co.kr/wp-content/uploads/2025/06/20231122142332001-100x70.jpg)